Sector rotation strategies for 2010 will leverage what worked in 2009 while adjusting to the realities of economic growth in 2010. The sector rotation strategy for 2010 takes advantage of the global growth from important emerging markets and the expanding role of the consumer throughout the world. The U.S. will face the potential of higher interest rates toward the end of the year, placing downward pressure on stocks. High unemployment will help to keep inflation in check as job growth turns positive but fails to provide enough jobs for many of the chronically unemployed and some of the new entrants.

These factors will have a profound affect on the economy and each industry sector. Technology, materials, industrials and consumer discretionary will do well. Utilities and finance will lag with healthcare, consumer staples and energy performing relatively well.

Sector Rotation Model

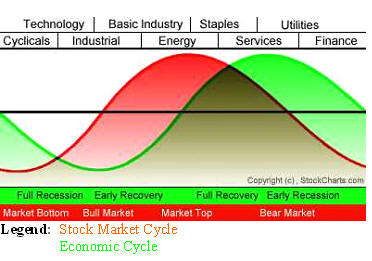

Sam Stovall of Standard & Poor’s describes a sector rotation model that assumes the economy follows a well-defined economic cycle as defined by the National Bureau of Economic Research (NBER). His theory asserts that different industry sectors perform better at various stages of the economic cycle. The nine Standard & Poor’s industry sectors are matched to each stage of the economic cycle. Each industry sector follows their cycle as dictated by the stage of the economy. Investors should buy into the next sector that is about to experience a move up. When an industry sector reaches the peak of their move as defined the business cycle, they should start to sell the sector. Using the sector rotation model, an investor may be invested in several different sectors at the same time as they rotate from one sector to another as directed by the stage of the business cycle.

Sam Stovall's Sector Investing, 1996 states that different sectors are stronger at different points along the business cycle. Be forewarned, this is a very expensive book, however it is worthwhile, as it is a thorough explanation of sector rotation strategy and model. The table below describes this theoretical sector rotation model throughout the business cycle.

|

Stage: |

Full Recession |

Early Recovery |

Full Recovery |

Early Recession |

The sector rotation chart below, courtesy of StockCharts.com, shows these relationships and the order each sector responds to the economic cycle. The Stock Market Cycle precedes the Economic Cycle as investors try to anticipate how the market will react to the changes to the economy.

Sector Rotation Chart

As indicated in the sector rotation chart, if you are in the right sector at the right time you can beat the market. The problem is deciding when to make the transition to a sector that has greater potential. Moving one's capital to a new sector too early will result in weak performance at best with losses more likely. On the other hand, if one is late getting into the sector you miss much of the uptrend and most of the profit opportunity.

One of the key elements of the sector rotation strategy, as shown in the chart, is to hold shares in more than one sector. The idea is to buy into the sector that is rising toward the top and then hold it until it turns down. As a sector turns down an investor rotates their money to the next sector that is rising toward the top and is expected to outperform. This strategy often means an investor will be holding a minimum of three sectors in their portfolio; one sector on the rise, one at the top and one that is starting to decline.

A sector rotation strategy can produce excellent opportunities, if you follow a sector rotation model that reflects an assessment of the current economic and industry situation. Each economic cycle tends to have different affects on specific industry groups. Each recession and bear market tends to have more significant affect on one or two industries. The impact on these industries can be enough to cause them to lag behind during the following economic recovery. Moreover, a new economic quandary causes industry sectors to react in new and different ways. As a result, the rotation of the sectors in the model may not play out as depicted.

Current Sector Rotation Analysis

The primary economic themes for 2010 will have the most influence on the rotation of the industry sectors.

As happens each year there are major economic themes that define the best investing opportunities of the year. In 2009 the rise of commodities coupled with the fall in the U.S. dollar was one such theme. As we enter a new decade and year, it will pay to evaluate the investing themes for 2010.

First, emerging markets, especially China, Brazil, India, much of Asia and other parts of Latin America will lead the rest of the world in economic growth. As a multi-year trend, this is continuation of one of the best investing themes from 2009. Demand for commodities such as copper and steel will be critical for this growth. The economic growth of these countries is encouraging the emergence of a new middle class.

For example, the World Bank estimates that the global middle class is likely to grow from 430 million in 2000 to 1.15 billion in 2030. The bank defines the middle class as earners making between $10 and $20 a day, adjusted for local prices. This is roughly the range of average incomes between Brazil ($10) and Italy ($20).

In China economists expect the country's "middle class" will exceed the total population of the United States by 2015. Overtaking the United States, more than 12.7 million cars and trucks will be sold in China this year, up 44 percent from the previous year and surpassing the 10.3 million forecast in the U.S., according to J.D. Power and Associates.

For investors, the expansion of the middle class in these countries will spur demand for certain consumer goods and better food, leading to more trade that encourages exports from the U.S. It also will help multi-national companies that are aligned with these growth waves to see stronger growth.

The commodity, industrial, and energy sectors should benefit as they provide many of the products for the emerging countries. Demand for technology products will increase, especially anything to do with wireless communication.

Second, the rapid expansion of wireless communication and cheaper computing is creating a significant jump up in productivity throughout the world. Higher productivity is the source of growing wealth for a country. The move to cloud computing will enhance this development as it opens up more computing power and access to software to individuals, small and medium sized businesses.

According to various reports and as reported in the economist, productivity is highest in the emerging countries of China, India, Singapore, Thailand, South Korea, and Indonesia. When people are more productive they generate higher incomes for themselves and their families, leading to theme one.

Most people believe the source for this higher productivity is the large investments being made by each country. This partially true. However, a more skilled and educated work force using newer technologies is essential to productivity expansion.

As people see their efforts payoff, they receive more disposable income leading to spending on better food and consumer goods such as clothing, refrigerators, clothing washers, cars, and trucks.

Again, exports from the U.S. will grow more as companies are able to provide the products and services in demand.

Third, the never ending expansion of government deficits, especially the U.S. is creating a flood of debt. Funding this debt absorbs capital from the world's economic system. Capital that could be used to grow companies and businesses. This competition for capital places upward pressure on interest rates, restricting growth.

As rates rise, it costs companies more to invest in new products and services. It also reduces expansion of job opportunities.

Investing opportunities lie with rising interest rates. We should look to invest part of our capital in Exchange Traded Funds that short long term Treasury bonds.

Fourth, governments are taking a more active role in the structure of their economies. Government influence can be positive or negative, depending on the policies. Unfortunately, governments tend to swing from one extreme to another causing business to be unsure what the future holds. As a result, they invest less waiting to see what policies will be in place before they make any strategic decisions. Slower growth is the result.

Presently, in the U.S. the $787 billion stimulus program will continue to rune through 2011, with approximately 30% being spent in 2010. Most of this spending is a continuation of what was spent by the government in 2009. Should there be any changes in the spending by the government, it will affect business opportunities, depending on the specifics of the policy.

Basically, any investing opportunities that count on government spending are limited at the present time. However, we need to monitor any new legislation and its potential affect on sectors.

Fifth, at some point the Federal Reserve will begin to raise interest rates. As long as jobless growth remains, meaning expansion of the economy is not sufficient to employ the large number of long-term unemployed and some portion of those entering the work force, inflation will not return. This gives the Fed some room to keep interest rates low. However, as they easy off the monetary stimulus, there will be pressure for rates to rise. Rising rates tends to place downward pressure on the stock market as capital costs climb. Speculation when the Fed will begin to raise rates will increase and have more influence on the stock market trend. So far the Fed has been communicating their intentions.

The Fed is developing tools that can help take reserves off the market. This week, the Fed proposed selling term deposits to banks, which would remove reserves from the day-to-day trading market, locking them up for as long as six months. When the Fed sells securities it removes money from the economy helping to reduce the excess supply of monetary stimulus.

In December 2009, the New York Fed began testing reverse repurchase agreements as another way to pull cash out of banks. In a reverse repo, the Fed contracts to sell and repurchase securities over a set period, draining cash from the banking system. By making small, publicly announced sales of bonds, the central bank would permanently drain excess reserves while limiting investor concerns about an increase in the supply of such securities, economists said.

The federal funds market underscores how the Fed may need to use several tools to hit its interest-rate target. While the Fed promises to pay banks 0.25 percent to keep excess funds on deposit at the central bank, the so-called effective rate, or market rate, has averaged 0.12 basis points this month.

Fannie Mae and other government-sponsored enterprises that are ineligible to deposit money at the Fed “have pulled down” the fed funds rate by selling funds in the market, New York Fed researchers said in a paper this month.

Fed officials must be cautious in how they manage reserves and raise interest rates, economists said. Even small amounts of bond sales could nudge up the cost of home loans.

The average 30-year fixed rate rose to 5.14 percent for the week ended today, the highest since August. A rise in short-term rates would boost the cost on floating-rate loans for consumers and businesses.

The Fed will increase the benchmark rate in the third quarter of 2010, according to the median forecast of economists surveyed by Bloomberg News this month. Vice Chairman Donald Kohn is among officials who have said the recovery needs to be self- sustaining, with the unemployment rate declining, before the Fed tightens. The unemployment rate will probably stay at 10 percent in December, according to the median estimate in a separate Bloomberg survey of economists before a Labor Department report on Jan. 8. Unemployment soared to a 26-year high of 10.2 percent in October.

Fed officials are considering the sequence for using their various tools for withdrawing monetary stimulus. They may start by raising the interest on reserves rate and draining reserves, followed by asset sales, Meyer said in a Dec. 15 research note. A second possible sequence would be first draining off excess reserves, then raising the interest on reserves rate later, followed by asset sales. I suspect the second sequence of events is more likely as it is less obvious to the public. Moreover, the Fed has signaled they intend to reduce stimulus by selling assets, while they expect to keep rates low for an extended period of time. Of course, that does not mean they will not increase the fed funds rate by a 0.25% sometime during the summer just to indicate the policy is changing.

Speculation when the Fed will begin to raise rates will be a dominating factor for many investors. What we do know is rates, especially longer term rates, will tend to rise over time. Trying to find the exact time will be much more difficult. Once again a good way to take advantage of this development during 2010 is to buy the ETFs that short the long term Treasuries.

themes: emerging markets will pull the rest of the world forward with demand for commodities, new demand for consumer goods and better food. demand for technology driven by wireless computing and productivity improvements will continue. Expanding government deficits will pressure the U.S. dollar to trend down. these three forces will encourage growth of exports by the U.S. threat of rising rates will weigh on markets, though inflation will remain benign as jobless growth in the U.S. remains in place.

In anticipation of a recovery in the economy, it is appropriate to perform an analysis of the sector rotation model in light of the current recession. According to the sector rotation model, the technology sector is one of the first sectors to recover from a recession and bear market. However, following the dot.com bust of 2000, many companies in the technology sector failed to rebound as quickly as would be expected. The impact of the bear market on the technology sector was extensive. Many companies disappeared completely. Others struggled to survive. Eventually a number of the technology companies began to thrive, however it was several years before doing so. Those investors that followed the standard sector rotation model were disappointed when they realized that the sector did not perform as the sector rotation model would indicate.

This raises the question – What sectors will be the best performers when the bear market that began in December 2007 finally ends? The place to begin to answer this question is to analyze the affect of the current recession of each sector.

The table below is a high-level analysis of the nine S&P 500 sectors as they might perform once the current bear market is over. A recession affects the business model of a company, some positively, some negatively. In addition, recessions can harm the financial strength of companies as they struggle to survive. Finally, government actions can cause changes in the way companies operate within the sector. Some of these actions are attempts to help the economy recover. Other government actions are due to new policies by the current administration. These policies may not be directly from the recession, yet they can have a significant influence on the industry.

| Sector | Changed Business Model due to Recession | Financial Strength | Government Influence | Summary Affect |

| Consumer Discretionary |

Partial due to affect of de-leveraging of households. Companies catering to the wealthiest individuals may also see an impact as compensation returns to more natural levels. |

Curtailed in the near future. Cannot count on expanding credit to fund spending. | Attempts to stimulate spending may not have the desired affect as consumers shore up their savings and reduce debt. | Slightly negative. Likely to hinder response of the sector to recovery of the economy. |

| Technology | Minor change due to lower spending by consumers. | Many companies are financially strong with significant amounts of cash on their balance sheets. | Might see some positive influence from higher investment in energy efficiency and other government-funded programs. | Positive. Sector is well positioned to take advantage of the economic recovery. |

| Industrial | Could be significant depending on the sub-sector and company. Some companies are likely to recover stronger, while others will be weaker and some will not survive. | Varies by sub-sector and company. Some firms have the significant financial strength, while others are very weak (autos). | Not significant, unless the company received government bailout money. Longer term, some firms could be affected by the move to greener energy. Some of the stimulus money will have positive affect on the engineering and construction firms. | Mostly neutral, though some sub-sectors and companies are and will feel dramatic positive and negative affects. |

| Materials | Minor affect. While the sector is experiencing losses, this is normal during a recession. | The large firms are well positioned and are likely to benefit, as new sources of minerals are not coming online, limiting supply. | Not likely to see much change. Longer term the issues with carbon emission could be more of a problem. | Neutral to positive. Lack of investment in new sources of minerals and materials is likely to result in higher prices and profits. |

| Energy | Recession is having minimal affect on the sector. Move to new energy could be more significant eventually. | Strong. Cash flows remain very positive and a recovery of the economy will drive up prices and profits. | None from the recession. However, could be significant as the movement to green energy heats up. Should prices rise to high, we could see new government initiatives. | Positive from the recession. Sector is likely to do well though the green initiatives could become a problem. If prices climb to high, we could see negative consequences as well. |

| Consumer Staples | No significant change. | Companies remain financially strong. | Minor changes. | Neutral. |

| Health Care | New investment and new regulations will have a dramatic long term affect. Insurance will see the biggest impact. Big pharmaceuticals will also see some negative impact. Bio-technology is likely to see a positive impact from investment in new ways to fight disease. | Neutral. Most firms have the financial strength to recover. Moreover, if everyone can receive coverage for healthcare there should be a large increase in the overall revenues to many firms. | Significant. Government will be much more involved in paying for healthcare and changes to regulations. | Some positive and some negative. |

| Utilities | Movement to lower carbon emissions model will negatively affect many companies, while raising costs. | Relatively strong as many are regulated firms. | Expect carbon emission standards to become reality. | Negative. |

| Finance | Significant affect on ability to lend with a return to the more strict lending rules. | Weakened significantly, as governments have had to step in to prop up many of the larger institutions. Paying back these “loans’ will take time and cost the companies for years. | Expect more government oversight and rules | Strongly negative. Some banks that have been able to avoid the affect of the toxic assets will do well. |

Overall, we should expect to see important differences in the way sectors and companies respond to a recovery from the recession and bear market. The massive de-leveraging process will influence any expansion in consumer spending. Those sectors and companies that depend on the consumer will struggle, as people save more and lower their debt. The technology sector should do well in the recovery. The consumer discretionary, a cyclical industry, should recover, though the affects of restrained consumer spending is likely to restrain their recovery. The materials and energy sectors should also do well. The industrial sector will have a mixed recovery, depending on the sub-sector and individual companies.

The financial sector will experience long-term difficulties due to the impact of the massive losses and new government regulation. Healthcare will see significant changes that will have positive and negative affects, depending on the sub-sector. Utilities will continue to feel the affects of the reduction in carbon emissions and the investments necessary to create a new energy environment. Consumer staples will continue to operate as before.

The Bottom Line

Your sector rotation strategy depends on an analysis of the affects of the current recession on each sector. This analysis of each sector’s rotation provides you a more informed investing strategy. Adjusting your sector rotation strategy to reflect the current analysis of the affects of the most recent recession will help to position your portfolio to benefit the most from the new bull market.