This free monthly stock market trends newsletter analyzes the trend line using the S&P 500 charts. Trend following is a proven strategy to beat the market and grow your stock portfolio. Technical analysis provides the tools to analyze and identify trends in the stock market. Since the S&P 500 trend line chart is the one used by professional traders for their analysis, it is important to understand how it is performing.

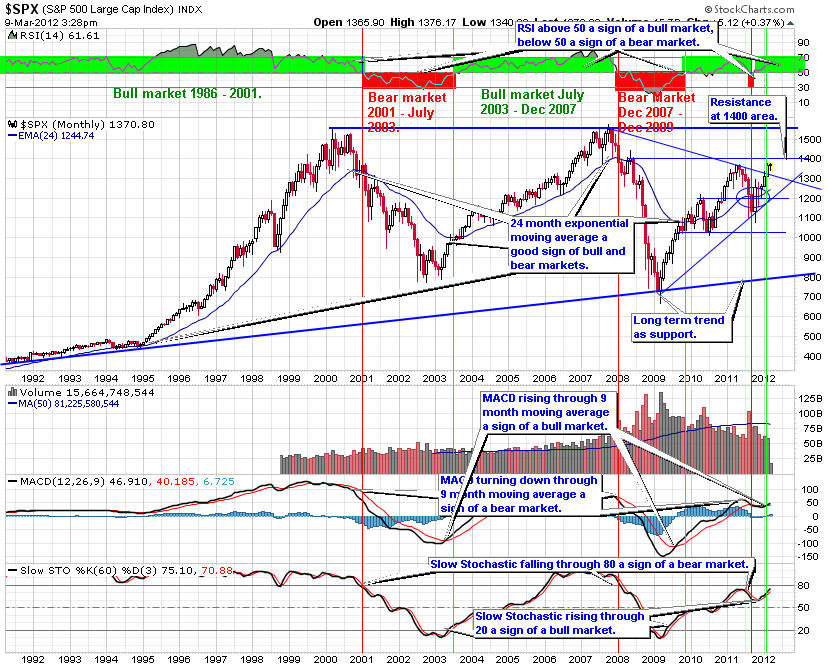

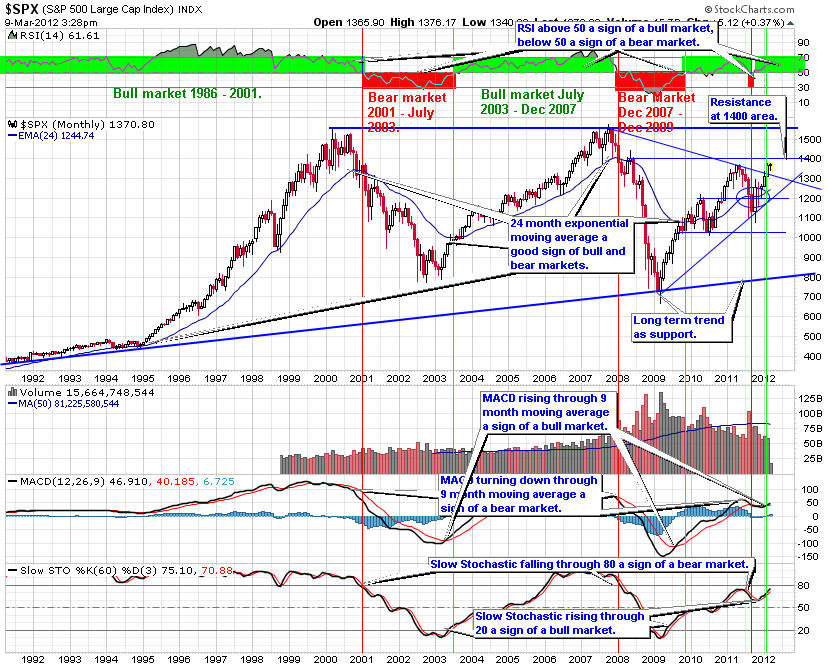

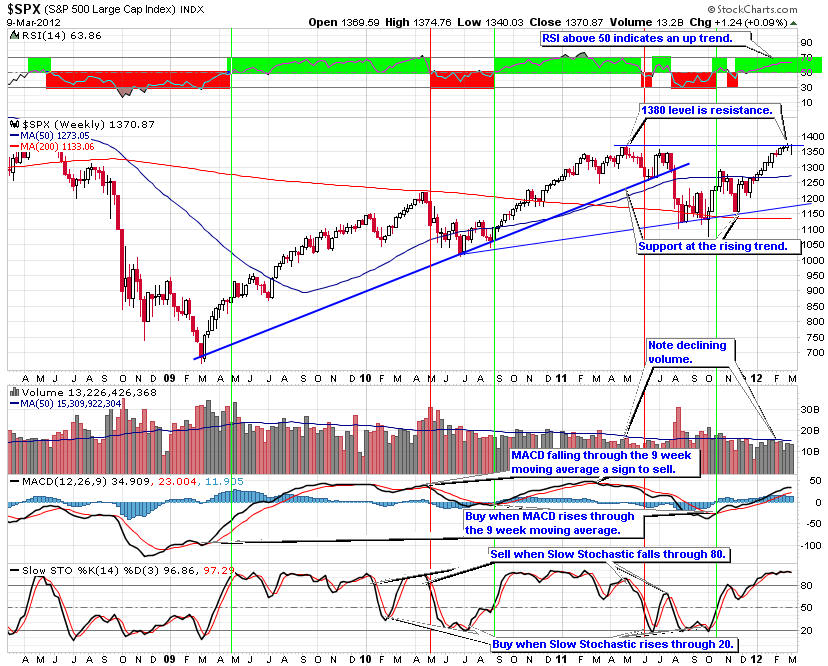

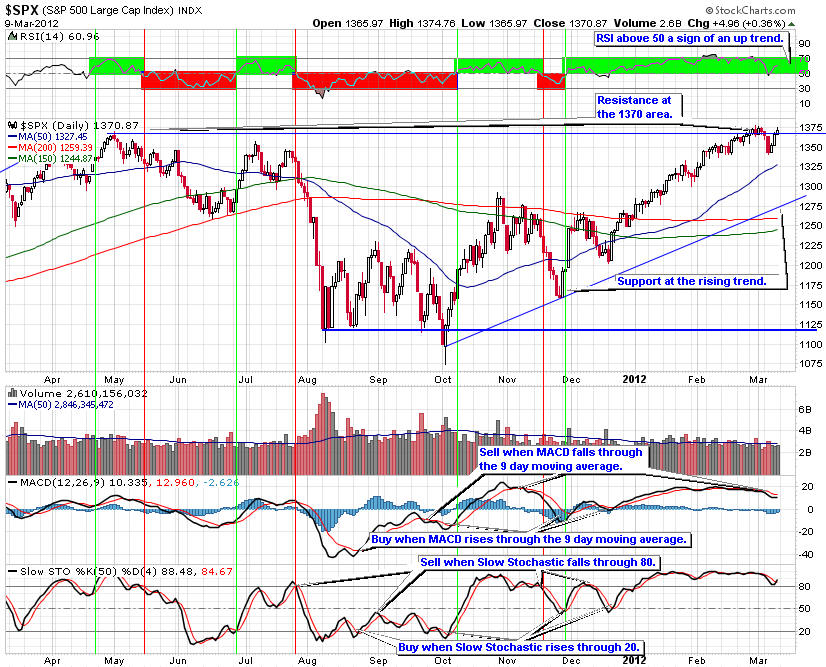

The analysis of the S&P 500 trend line starts with the 20 year monthly view of the S&P 500 chart. Next we examine the weekly chart of the S&P 500 trends to get a shorter term view. Finally we analyze the one year daily chart of the S&P 500 trends to get a even shorter term view. On each version of the charts of the S&P 500 trend line, the view and the value of the indicators change, as we move from a monthly to a weekly and then a daily chart.

Starting with the monthly view of of the S&P 500 trend chart, the bull market of the last five years turned down, as the index fell below the 24-month exponential moving average. The Relative Strength Indicator (RSI) is below 50, indicating a down trend is in place. The Moving Average convergence Divergence (MACD) is also below zero, a sign stock market trend has reversed and we have entered a bear market. Finally, the Slow Stochastic fell through zero, another sign of a bear market.

The analysis of the monthly trends of the S&P 500 chart, shows we remain in a bear market with key resistance at the 24-month exponential moving average. Support at the 25 year rising S&P 500 trend line has been tested and held so far.

The three year weekly S&P 500 trend line chart shows more closely the transition from a bull to a bear stock market. So far, the descending trend line and the 50-week moving average are the primary resistance levels for this view of the bear market.

Most recently, the index formed a small descending triangle pattern, a bearish formation. In February, it fell through support and is likely to fall to the 600 - 650 level.

RSI below 50 indicates a down trend. MACD turned up through the nine week moving average, a buy sign. However, it is turning down again. Slow Stochastic turned back down through 20, a sign of weakness.

Long term, the trend of the S&P 500 chart is still down. The weekly pattern indicates that weakness continues, though we are close to a low point and could see a rebound in the near future.

The daily S&P 500 trend chart shows the formation of a descending triangle pattern, a bearish pattern. The S&P 500 fell through support at the 800 level and continues to fall.

RSI is below 50 indicating a down trend. The MACD turned down through the nine day moving average, a sell sign. The slow stochastic turned down just above 50, a sign of weakness.

The break down through the 800 level of the descending triangle on the S&P 500 trend chart is a sign of further weakness in the market. Moreover, the pattern gives us a target of 600 on the S&P 500. This does not mean the index will fall there in a straight line. Rather, we could see a rebound at the 700 level, possibly back to 740 or 800, before the index turns down again.

A measured move is a way technicians determine a price target based on a technical pattern. The theory is the market tends to move in equal increments or waves. For a descending triangle the price target is equal to the height of the triangle after a break of support. For the descending triangle on the S&P 500 trend line chart, the top is 1,000 and the base is 800, resulting in a height of 200. Subtract 200 from the base of 800 gives you a price target of 600 on the S&P 500 trend chart. This means we are likely to see the S&P 500 trend line chart fall to the 600 - 650 level before it turns up.

In bear markets, it is best to be nimble and/or use risk protection such as trailing stops, protective put options and even covered call options. On a sign the market is unable to rise through resistance, you might consider using the short and ultra short Exchange Traded Funds (ETFs).

Given this analysis of the S&P 500 trend line charts, it is important to have your portfolio positioned for a fall to 600 on the S&P. This means investors should assess their long positions to reduce risk. When the stock market trend is down during a bear market, the best trend following strategy is to be in cash and be short. The short and ultra short ETFs are good ways to short the market without having to depend on selecting specific stocks.

While it is tempting to buy when the trend is down, it is a better strategy to be sure the stock market trend is in your favor. Conserve your capital and be ready to join in a rally by identifying the best sectors and companies that will beat the market in the next rally. Keep in mind, Warren Buffett's first rule of investing is to not loose money. Patience is key when markets are moving down.

Our Premium Members receive weekly analysis of market trends of all major indexes and industry sectors. They also receive frequent updates when conditions warrant, so they are prepared to trade and invest with the trend. Moreover, our stock and sector portfolios have beat the market every year since our inception in 2005. For 2009 we are up for the year, while the S&P 500 is down over 17%.

Try the free four week subscription to our Premium Members pages and receive:

If you decide to continue at the end of the four-week trial your subscription starts automatically. If you decide to cancel before the end of the trial, you will not be charged a thing. No risk, no obligation.

Give the Premium Membership a try. You have nothing to lose and a lot to gain and we have beat the market every year since our inception.