5/02/2008

If you are learning to invest it is important to understand what drives the

economy. Consumer spending is a critical determinant of the

direction the economy takes. The consumer makes up more than 70% of the Gross

Domestic Product (GDP) of the

The strength of the economy is a major determinant of the trend for the stock market. Investors that beat the market monitor closely the state of consumer spending to help identify the trend in the stock market.

To gain an understanding of the strength of the consumer, it is helpful to look at the major sources of consumer spending in the recent past. Then we should examine what are the future sources for consumer spending.

As shown in the chart below the average Real Personal

Consumption Expenditures in each of the most recent expansions has declined from

an average of 4.2% in the 1983 to 1990 expansion to 3.1% during the latest

expansion. The chart below is from John Mauldin’s “Outside the Box”

In the latest expansion real wage and salary income that

rose just 1.8%, caused by only a 0.8% growth in payroll employment, the smallest

of any expansion since World War II. This is a real concern for the

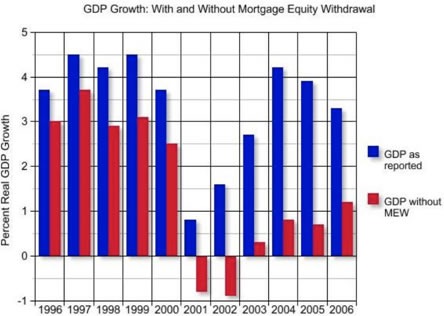

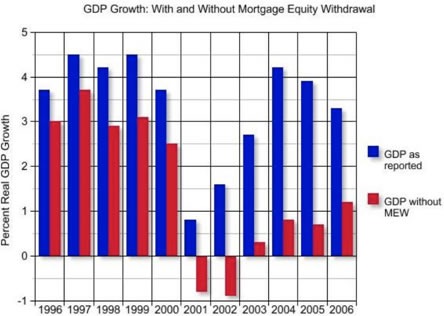

What makes this situation even more of a concern is the PCE

would have been worse. As you may have heard, consumers have taken advantage of

the rising values of their homes to extract cash through refinancing. The

housing and credit crisis we are now experiencing has put a stop to this source

of cash for consumers. The following chart is from John Mauldin’s Weekly

E-Letter, Front Line Thoughts,

Not to belabor the point but the cost of important basics

like food and gasoline keep rising. People are spending more of their available

money on these necessities. The price of oil is expected to remain high for

years to come driven by the growing demand from the rising middle classes in

many parts of the world. These people also want to eat better which helps drive

up the price of important foods such as rice, wheat, corn, soybeans and meat. In

short, there is growing competition for these commodities that have been priced

much lower for many people in the

The future of consumer spending is very important to investors since it comprises more than 70% of the US GDP. So what does the future hold? For some guidance, we should look to where consumers can derive their money. Let’s start with what people are earning from work.

Many people have secure jobs that provide the income they

need to meet the necessities of life. The companies they work for are in good

shape and seem better prepared to meet an economic slow down. They continue to

improve their productivity a number of them are positioned to take advantage of

the growing middle class in

While the latest unemployment went down from 5.1% to 5.0%,

a look at the underlying numbers raises some interesting questions. The economy

added 39,000 professional and technical jobs in April. However, there were

losses in construction, manufacturing and retail, primarily lower skilled jobs.

The

What seems to be happening is the

Those without the necessary education and skills are facing a much more difficult situation. The jobs available to them are lower paying, if they can find them at all. As a result they will cut back on their spending, trying to make ends meet. All the promises by politicians will not give them higher paying jobs. Their only answer is to get the necessary training and/or education to make them much more employable. In the mean time, they will help hold back the growth of consumer spending for years to come.

Finally, we have the “Baby Boom Generation” that is about to reach retirement age. Many of these people are not fully prepared to go into retirement, as they do not have sufficient savings and investments to meet their needs. Some will work longer, if they can. Others will find other ways to provide some income during retirement, by working at lower paying jobs. As a result, they will not be in a position to drive growth in consumer spending. Even those who can retire comfortably, they are unlikely to spend more as they have already bought most of what they needs. Their level of spending is likely to be reduced as they go through retirement. Of course, healthcare will see an up tike in demand. The only question is how much will it and who will pay.

A slow down in the growth of consumer spending will have a

significant impact on the